[ad_1]

The world’s main cryptocurrency, Bitcoin (BTC), has seen a major surge in its value at this time, reaching $28,004. Whereas a number of components have contributed to this bounce, listed below are the first causes:

#1 SEC’s Non-appeal On Grayscale Spot Bitcoin ETF

Late on Friday night time, the market grew to become conscious of the US Securities and Trade Fee’s determination to not enchantment the decision which favored Grayscale’s conversion of the Grayscale Bitcoin Belief (GBTC) right into a spot ETF. This determination wasn’t maybe absolutely priced in on Friday, as Bitcoin’s value rose by a mere 1.2% on Friday ((adopted by a quick retracement), in stark distinction to the 8% spike on August 29 when the preliminary ruling was introduced.

The transfer signifies the SEC’s potential readiness to green-light a Bitcoin ETF within the imminent weeks. As one Grayscale spokesman pointed out, “The Federal Guidelines of Appellate Process’s 45-day interval to hunt rehearing has now handed. The Grayscale workforce stays operationally able to convert GBTC to an ETF upon the SEC’s approval.”

James Seyffart from Bloomberg Intelligence highlights the possible talks between Grayscale and the SEC within the close to future, stating, “Dialogue between Grayscale and SEC ought to start subsequent week. Hoping for more information on subsequent steps someday subsequent week or week after?”

As for when a Spot ETF is coming, Bloomberg Intelligence analysts predict a staggering 90% probability of the SEC’s approval by round January 10.

#2 BTC’s Correlation With Gold

Famend analyst MacroScope lately offered in-depth insights into the advanced relationship between gold and Bitcoin which can have contributed to at this time’s value transfer. Gold has soared by greater than 6.5% from October 6 until Friday final week, pushed by a mixture of components reminiscent of central financial institution insurance policies, the US’s fiscal challenges, and unfolding geopolitical occasions just like the Israel-Hamas struggle.

Remarkably, the Gold market has been witnessing a discernible sample: savvy traders, typically labeled because the ‘sensible cash’, have been strategically capitalizing on value dips to reinforce their lengthy positions. This habits has been significantly pronounced across the $1820-1860 value marks, suggesting a foundational shift in gold’s pricing trajectory.

Associated Studying: Analyst Predicts Subsequent Bitcoin Cycle Prime – Is It $89,000 Or $135,000?

This evolving dynamic within the gold market bears vital implications for Bitcoin. Traditionally, gold typically pioneers a development, with Bitcoin tailing behind to emulate it. This lead-lag relationship, as highlighted by MacroScope, might need been pivotal in forecasting Bitcoin’s transfer at this time. As gold seems to be charting a bullish course, Bitcoin, whereas influenced by its distinct set of catalysts just like the spot ETF approval, may very well be poised to reflect gold’s trajectory.

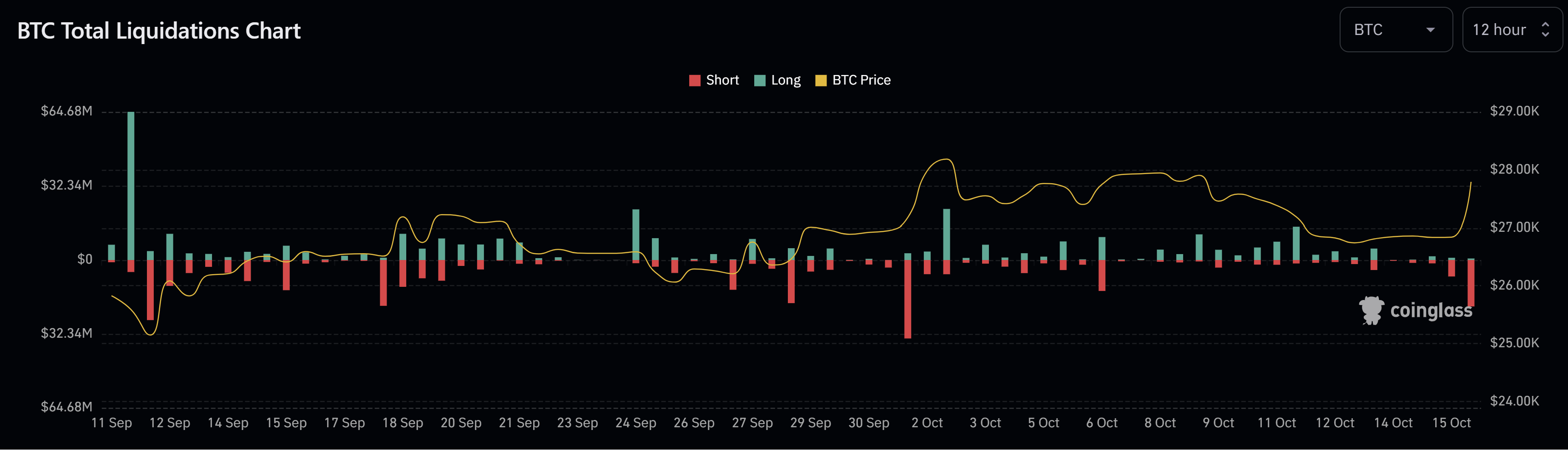

#3 Brief Squeeze

Lastly, on a extra technical notice, there was vital exercise within the BTC futures market that performed an element within the hovering value. To date at this time, about $20 million in brief positions have been liquidated, the best quantity since October 1, when $37.5 million in shorts have been liquidated and BTC rose 4% from $27,000 to just about $28,100 in a really brief time period.

In conclusion, Bitcoin’s spectacular surge to $28,000 will be attributed to a mixture of regulatory developments, its correlation with gold, the rising affect of massive holders or ‘whales’, and vital futures market exercise.

At press time, BTC traded at $27,880.

Featured picture from iStock, chart from TradingView.com

[ad_2]