[ad_1]

Apple simply noticed its highest-ever quarterly shipments in India in Q3. The numbers come because the nation’s general numbers stay flat. Between July and September, the Cupertino agency shipped greater than 2.5 million iPhone models in India, analyst agency Counterpoint stated on Wednesday. The file shipments marked a 34% year-on-year improve.

The iPhone 14 accounts for greater than a 3rd of iPhone gross sales in India in 2023, Counterpoint advised TechCrunch.

Apple has a single-digit market share in India that has to date did not crack the highest 5, however the firm has began drawing many purchasers because the world’s second-largest smartphone market has begun shifting towards premium fashions. The iPhone maker has additionally been bullish on the South Asian nation and is increasing its native manufacturing footprint within the nation because it appears to be like past China for manufacturing.

Final yr, Apple had a 4.5% market share, which is anticipated to develop to six% in 2023, Tarun Pathak, analysis director at Counterpoint, advised TechCrunch.

“Whereas general smartphone shipments are more likely to decline by 5% in 2023, Apple will develop by 38% in India,” he stated.

Counterpoint stated the nation’s general smartphone shipments remained flat within the third quarter. Nevertheless, the market is “displaying indicators of restoration,” with client demand progressively selecting up forward of the festive season.

“We noticed some attention-grabbing launches, with key options like 5G and better RAM (8GB) diffusing to reasonably priced smartphones (sub-INR 10,000, ~$120),” stated Shilpi Jain, senior analysis analyst at Counterpoint. “India’s smartphone market will expertise development within the coming quarter because of pent-up demand, elongated festive season and quicker 5G upgrades.”

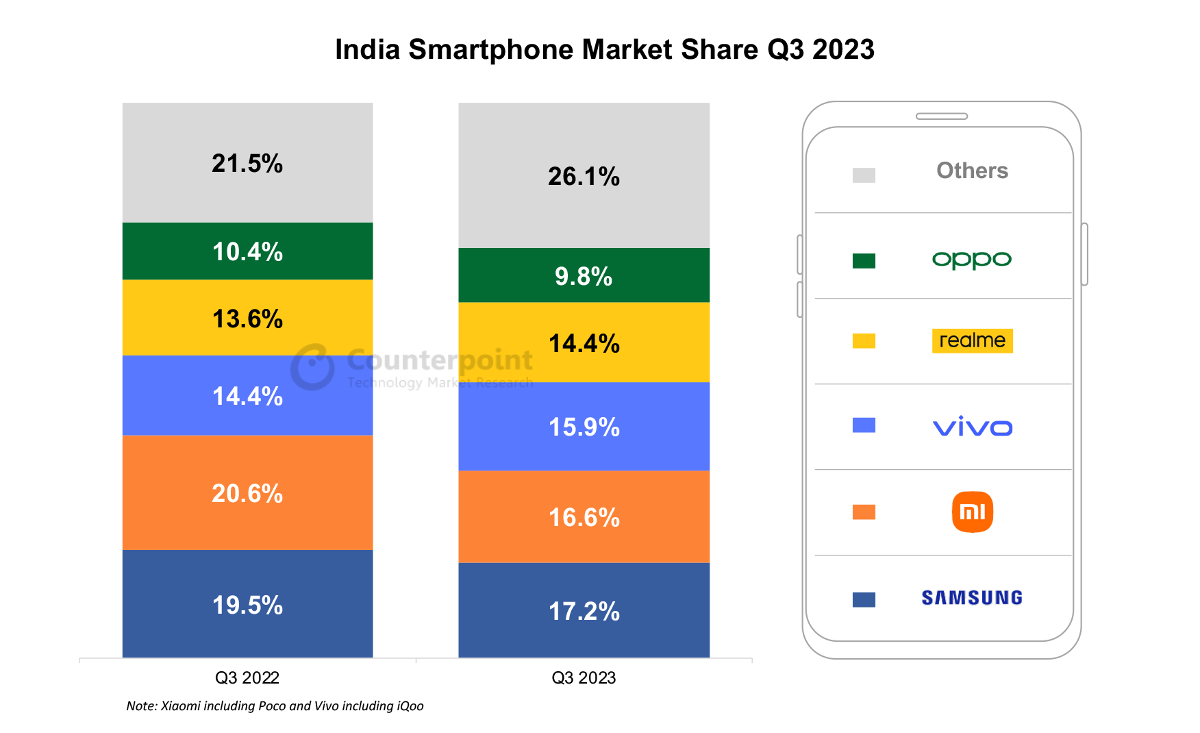

Samsung continued to be the most important vendor available in the market, with a 17.2% share, adopted by Xiaomi’s 16.6% share. Nevertheless, each Samsung and Xiaomi noticed a decline of their shares from the identical quarter final yr, down from 19.5% and 20.6% share, respectively.

Picture Credit: Counterpoint

Vivo emerged third in Q3, turning into the fastest-growing model among the many prime 5, with an 11% year-on-year development. The Chinese language firm captured 15.9% of the overall smartphone market, up from its 14.4% share in Q3 2022.

The shift towards premium fashions helped Vivo sibling and BBK Electronics subsidiary OnePlus change into the highest model within the reasonably priced premium phase (beneath $360–$540), with a 29% share. Nevertheless, within the general market, Transsion manufacturers, together with Infinix, Itel and Tecno, grew the quickest, with 41% year-on-year development.

Nokia (owned by HMD) and Motorola each additionally skilled year-on-year development throughout Q3, with Nokia at 31% and Motorola at 27%. Moreover, Realme and Google noticed single-digit development of seven% and 6%, respectively.

[ad_2]